Infrastructural growth has slowed considerably in the two years ending 2016-17 and remains sluggish because of lack of sustainability.

While the years since 1991 are often presented as a period of ‘reform’, when an excessively interventionist state was put in retreat, one area in which the government’s role has increased hugely is infrastructure. Based on the premise that infrastructural investments are crucial to a growth strategy that seeks to garner for India the gains from better integration into global value chains, they have been the focus of public policy, with emphasis on grand infrastructural mega-projects. The latter include “prestige projects” such the Delhi-Mumbai industrial corridor and the bullet train.

This external content requires your consent. Please note our privacy policy.

Open external content on original siteState as backer of private interests

The state has entered these areas not just as an investor, but as a facilitator and backer of private investment through public-private partnerships or pure private sector projects, helping with land acquisition, environmental and social safeguard clearances, innovative means of financing, a reformed pricing environment, and ‘viability gap funding’. The motivation here is not just “need”, or the presence of infrastructural gaps. Rather, across the so-called “emerging markets” large infrastructure projects in a subset of areas, such as airports, ports, roads, telecommunications and power, are being presented as the means to “brand” the country concerned as a destination of choice for foreign investors, who are seen as the levers of successful growth through liberalisation. In the event, government policy is being changed to hasten the launch and completion of infrastructural projects to encourage private participation in the infrastructural area, to attract foreign investors into this domain, and to direct finance to infrastructure, including through ostensibly “innovative” means. This effort is often backed with finance from publicly owned or sponsored banks and financial institutions, even bypassing appropriate due diligence mechanisms relating to financial viability and environment and social impact.

However, the ambitious infrastructure agenda of the government has run into multiple constraints. Projects have run into difficulties at inception, in the course of execution or after commissioning. The reasons for these difficulties are varied: Inability to acquire the required land due to farmer resistance, failure to obtain environmental clearances, cost overruns, disputes over pricing with consumers or regulatory agencies, and sheer non-viability of badly designed projects.

Dispossession and displacement

While all of these issues have been highlighted in the public debate, two have not received the attention that is their due. One is the effect of asymmetric power relations, between the government with its power of eminent domain and large private investors on the one hand and small and medium landowners on the other, on the terms of land acquisition for these projects. The other is the damaging impact that many of these projects have on the environment. In the effort to push ahead with the expansion agenda and render the process private-investor friendly, environmental concerns, critics argue, have been given short shrift.

Displacement and disputes over land acquisition and weak environmental regulation, shortfalls in compliance with prevalent laws, and poor monitoring and enforcement have plagued the infrastructure landscape. While instances of violation abound, discussions have focused on particular cases of investor withdrawal such as the POSCO steel project in Odisha or the Tata small car project in Singur, West Bengal. Using such cases, the government, worried by the loss of momentum on the infrastructure front, has presented land acquisition problems and delays in provision of environmental clearances as an impediment to development. In the event, the effort has been to dilute laws and relax monitoring, rather than strengthen regulation.

Examples of projects euphemistically labelled as “stalled” are many. In the case of the infamous 316-mile, Mumbai to Ahmedabad, “bullet train” project launched in 2017, only a miniscule fraction of the 1,400 acres of land needed has been acquired. In the event the 2023 deadline for completion – which the government claimed would be brought forward by a year – is unlikely to be met. The Delhi-Mumbai industrial corridor project too is way behind schedule, with the completion of phase 1, that was to have happened by 2012, now slated for 2019. This has been the fate of many a mega project. According to a recent study by Care Ratings, 71 per cent of 1,361 infrastructure projects under implementation, of which 400 are mega projects with investment of over Rs.10 billion, are delayed and a majority have no definitive timeline. In the case of 358 affected by cost overruns, the additional investment requirement amounts to as much as a fifth of the original cost estimate.[1]

Infrastructural investment trends

But investment in infrastructure has been proceeding apace, till recently. According to the G20’s Global Infrastructure Outlook[2], the cumulative investment in infrastructure in India increased by 66 per cent over the eight year period 2007-2015 from $49.5 billion to $82.1 billion in 2015. But this pace of expansion is clearly not seen as enough. If this trend continues the cumulative investment over 2016-2040 is projected at $3.93 trillion at constant 2015 prices and exchange rates, which is short of an estimated actual requirement of $4.45 trillion, leaving a gap of $526 billion. This does not include the $880 billion at 2015 prices needed to meet additional investments in the electricity and water sectors if the SDG goals are to be realised.

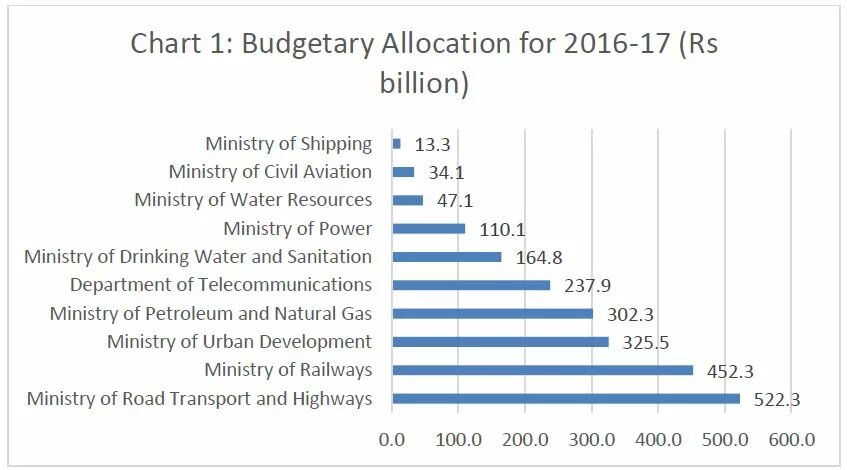

While definitions of what constitutes infrastructure vary in the literature, it is accepted that a wide variety of projects in sectors varying from transportation through urban development, water and sanitation to petroleum, telecommunications and power are to be counted as part of infrastructure. But not all sectors receive the same degree of attention. Judging by allocations in the central budget, the main areas of infrastructural expansion are roads and highways, railways, urban development, water and sanitation, petroleum and natural gas, telecommunications and power (Chart 1). These were sectors that received between Rs.100 billion to a little more than Rs.500 billion in the budget for 2016-2017.

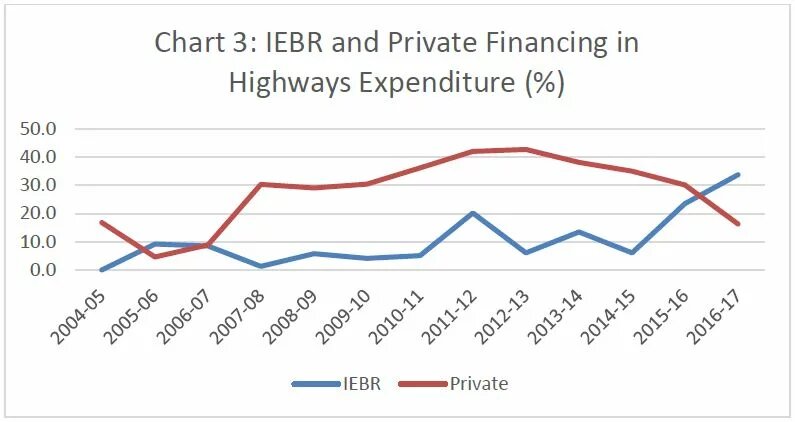

Investment in many of these areas had been substantially enhanced since the early 2000s, though there are signs of year-to-year volatility. For example, if we consider one area of accelerated expansion, which is national highways, investment rose significantly in the years to 2011-12 and then fell and stagnated, before rising sharply in 2015-16 and 2016-17 (Chart 2). The factors underlying this trend speak to the manner of evolution of the financing of infrastructure. Initially, highways expenditures were financed largely from the budget with private investment in the highways sector being extremely small even after liberalisation. However, over time two trends are visible. First, a sharp increase in the share of “internal and extra-budgetary resources (IEBR)” in the financing of public sector investment, from less than 10 per cent to as much as a quarter and a third in 2015-16 and 2016-17. This was largely borrowing by institutions such as the National Highways Authority of India (NHAI). Second, an increase in the share of the private sector in total highways expenditure to levels amounting to 30-40 per cent of the total (Chart 3). What the official figures do not show is that private investment too was substantially financed with debt, often from public banks or “government sponsored entities” like the now bankrupt IL&FS.

Dependence on debt

Thus, in post-liberalisation India, the financing of the infrastructure thrust has taken an unexpected route. In the past, in the absence of active long-term bond markets, the funding for capital intensive, long gestation projects came either from the government’s budget or from specialised, publicly owned or promoted development finance institutions (DFIs) supported by the government and the central bank. However, the principal, publicly-owned DFIs were closed or transformed into commercial banks as part of liberalisation, and fiscal reform limited the contribution that the budget could make to infrastructure development. In the event, the financing of infrastructure came to depend on credit from the public banking system, from international financial institutions (like World Bank, ADB, AIIB and NDB), and from new government sponsored entities like the Infrastructure Leasing & Financial Services (IL&FS) or the National Infrastructure Investment Fund (NIIF). Mandated to drive infrastructure investment, the exposure to infrastructure of banks, which do not have the necessary expertise to assess risk in the area, increased, and the specialised institutions such as the IL&FS and NIIF sacrificed “due diligence” in the pursuit of lending volumes. Infrastructure expansion became heavily dependent on both public and private borrowing.

Since borrowing from financial institutions was on fully commercial terms, the projects had to be designed to yield returns that can ensure that the debt incurred could be serviced and repaid. Policy has partly sought to ensure such yields by allowing greater flexibility in the setting of tariffs or user charges. Besides the increase in tariffs due to the withdrawal of explicit or implicit government subsidies, this flexibility has also led to complaints of overcharging. Even where regulatory authorities are involved in computing costs and setting remunerative prices, complaints abound that costs, especially capital costs, have been “gold-plated” to the benefit of private infrastructure providers.

Meanwhile, the reliance on debt from banks has led to defaults and non-performing assets (NPAs). Often these long term loans that are relatively illiquid are funded with short term capital, leading to maturity and liquidity mismatches. That can prove a problem if the projects do not perform as expected. This has been the case in India in recent years. Thus while a sharp rise in bank lending to infrastructure since the early 2000s has taken the share of that sector in lending to industry to more than a third, according to the June 2018 edition of the Reserve Bank of India’s Financial Stability Report, close to 23 per cent of those advances are stressed.

A typical case here is the power sector. According to an analysis by Bank Of America-Merrill Lynch (BofA-ML), total stressed assets in the power sector stood in August 2018 at $51.6 billion, of which banks held $36.1 billion and non-bank lenders like the Power Finance Corporation and Rural Electrification Corporation $15.5 billion.[3] This has precipitated a crisis with the Reserve Bank of India requiring banks to take these unresolved bad debts to the National Company Law Tribunal for quick resolution or liquidation. That would mean that the power producers may have to suspend operations, with effects on the rest of the economy. It would also mean that the banks would have to provision for losses resulting from the “haircuts” they are forced to accept, requiring additional capital if they are to stay in business. To address this twin problem in a crucial sector, the government is mulling the possibility of creating an asset reconstruction corporation to take over the distressed assets, and of recapitalising banks to compensate for their losses. Meanwhile, lending to the power (and other infrastructural sectors) is frozen, slowing down the process of infrastructural expansion. Even the assumption that the trend in infrastructural investment observed during 2007-2015 would continue may be optimistic.

Growth slowdown

This would aggravate a slowdown that is already underway. According to the current series of the Index of Industrial Production, with base 2011-12, growth in the infrastructural and construction sector, which exceeded the overall industrial growth rate during 2011-12 to 2014-15, has slowed considerably in the two years ending 2016-17, and remains sluggish (Chart 4). This is because in certain infrastructural areas, the rapid expansion since 2010 is now proving to be unsustainable. Consider the roads and highways network, which given India’s geographical size is the second largest in the world. That network having grown by an average of 0.1 million kilometres (from 2.33 million km to 3.37 million km) over the 1990s and 0.13 million km a year (to 4.68 million) over the 2000s, expanded at a much higher 0.24 million km a year (to 5.40 million) over the next three years to 2013-14. The acceleration of road expansion in the first half of the second decade of the 21st century was substantially on account of the roll out of rural roads, including those constructed under employment schemes. But growth has slowed dramatically to 0.1 million km a year over the two years ending 2015-16.

The recent deceleration in road length expansion appears to be occurring despite substantial increases in fund allocations for investment in the sector. As Chart 5 shows, central budgetary allocations for capital expenditure by the Union Ministry of Road Transport and Highways rose from around Rs.100 billion during 2012-13 to Rs.500 billion in 2017-18 and a projected Rs.600 billion in 2018-19. Moreover, to meet its ambitious declared goals the government has been encouraging private investments through public-private partnerships (PPPs) of various kinds. Yet the total length of roadways in place has increased by only 0.1 million km a year since 2013-14.

The official Economic Survey, 2017-18 attributes this mess in the infrastructural sector to the “collapse of Public Private Partnership (PPP) especially in power and telecom projects; stressed balance sheet of private companies; (and) issues related to land and forest clearances.” This way of posing the issue does not highlight the inadequacies and failure inherent in the design and implementation of the government’s infrastructural push. Given the growing opposition to and resulting difficulties in land acquisition, and the increased sensitivity with regard to deforestation and environmental pollution, planning multiple projects that require large and/or locationally concentrated land acquisition is clearly wrong policy. It is a blunder if in addition credit is provided and work on the project begun before all clearances are obtained.

Evidence of failure due to poor design and implementation is rife in the power sector. According to industry sources, 86.12 giga watt (GW) of constructed thermal power capacity is under different degree of stress. The stress is reportedly due to “under-recovery”, or revenue accruals lower than cost, in the case of 11.7 GW, absence of a stable power purchase agreement that ensures offtake in the case of 19.7 GW, and the higher cost of imported coal in the case of 9.8 GW. In the rush to expand infrastructure and in the belief that the government would bail them out in case of difficulties, investors in and managers of power infrastructure have been creating capacities that are now unviable. Among the reasons cited by the Parliamentary Standing Committee on Energy for financial stress of these projects are: non-availability of fuel, absence of PPAs, delays in implementation, and aggressive bidding in PPA auctions leading to “under-recovery”. In the view of the Standing Committee, rather than acting rationally while quoting tariffs, private players bidding for projects submitted irrational quotes that underestimated costs. With losses incurred on every unit of electricity generated, they find themselves unable to service their loans. Project non-viability and the credit conundrum are the results of failure of the strategy to induct private players into the financing of power projects and into the creation and management of generation and distribution facilities.

Foreign borrowing

A related issue is that borrowing for infrastructure includes a significant and rising share of foreign borrowing. Fiscal conservatism combined with infrastructural ambition has necessitated reliance on multiple sources of international financing for infrastructure, such as private international financial markets, bilateral donors and multilateral lenders such as the World Bank and Asian Development Bank, and new ones like the Asian Infrastructure Investment Bank (AIIB) and the New Development Bank (NDB). These institutions too exert influence on policies relating to infrastructural development and provision. Of the $4.4 billion investments in 25 projects approved by the AIIB between its establishment in 2016 and mid-2018, $1.2 billion has been for six infrastructure projects in India. The AIIB has also sanctioned $200 million investment in India’s National Investment and Infrastructure Fund. Since infrastructure output is largely non-tradable, borrowing of this kind requires generation of foreign exchange for financing debt servicing. Moreover, such borrowing carries considerable foreign exchange risk given the long term tendency for depreciation of the rupee relative to the dollar. So foreign financing, that appears an effective option, increases vulnerability.

A collateral effect of such inherent vulnerability is the unwillingness of project promoters to meet acceptable norms of compensation for land acquisition or undertake essential expenditures aimed at mitigating adverse environmental impacts. This makes government regulation, monitoring and enforcement crucial. India has a range of laws and subordinate legislation in these areas, not all of which are adequate to the task in different infrastructural sectors. What is more, the evidence is that monitoring and enforcement leave much to be desired and often work only when there is third party intervention by civil society organisations. A study by the Centre for Policy Research [4] on the effectiveness of monitoring protocols concluded thus: “First they are mostly practised as one off inspections rather than ongoing efforts by the regulators for collaborative monitoring along with the affected parties. Second, they do not act as deterrents against non-compliance. Checking the boxes after site inspections and giving warnings through notices as components of these protocols have not been able to instill a commitment to comply amongst project developers. Third is the focus on standards rather than effects of pollution.”

All this has happened despite the government’s claim that it has put in place a robust regulatory apparatus in the infrastructural sectors. The government’s role as facilitator was to be combined with the creation of relatively ‘independent’ regulatory bodies to prescribe rules for and monitor implementation of rules relating to social safeguards during project implementation and operation, environmental norms and standards, pricing and quality of service provision. In the event, the infrastructural ‘boom’ has been accompanied by the emergence of multiple and confusing levels of governance of the infrastructural space. But most stakeholders are unhappy with the outcomes of the government’s push.

Meanwhile, progress in social infrastructure, such as health and educational infrastructure, has been extremely slow and way short of the government’s own target. Moreover, private provision and the share of private facilities in the total have risen sharply, raising questions with regard to access, besides quality. This difference, pointing to significant inequalities in the distribution of benefits from the infrastructure boom, is in keeping with the increase in inequalities in wealth and income that have been characteristic of the liberalisation years.

Disclaimer: This article was prepared with the support of the Heinrich Böll Stiftung India. The views and analysis contained in the publication are those of the author and do not necessarily represent the views of the Heinrich Böll Stiftung.